Challenges Facing Afghanistan and the Banking Sector

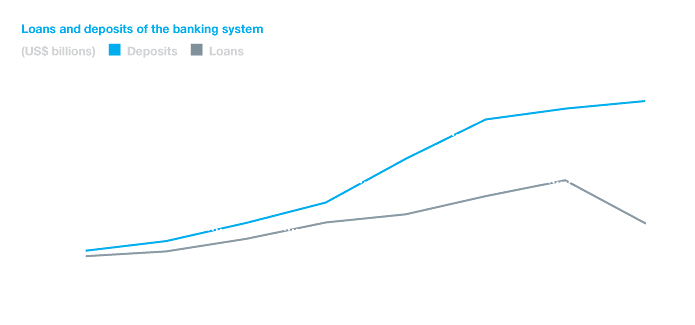

However, given the situation in Afghanistan, uncertainties in the economic, political, and security environment, especially the 2014 transition, could potentially create challenges for the banking sector and affect financial performance.

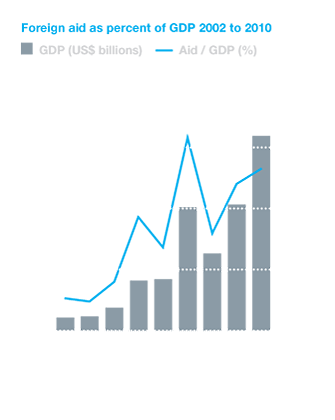

- Foreign aid contributed more than 110 percent of GDP in 2010. Reduction in foreign aid and military spending could lead to prolonged economic downturn.

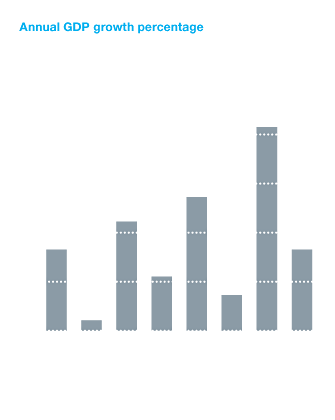

- Recent real GDP growth has shown high volatility, with GDP growth estimates for 2011 at 6.0 percent, down from 8.0 percent in 2010 and 21 percent in 2009.

- The withdrawal of US and NATO forces by 2014 may affect business sentiment with reduced investment and associated capital flight.

- Macroeconomic shocks such as GDP decline, currency devaluation, and commodity price rises are all potentially damaging to the loan portfolios of banks and their capital base.

AIB’s Board is actively monitoring these trends through our Risk Committee. At this point, the Bank is adopting a more conservative profile in its lending and investment policies in anticipation of the fallout from the 2014 transition.

Nevertheless, the Board and management believe that AIB will continue to grow over the next few years, albeit at a slower rate.