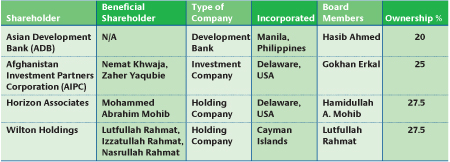

Shareholders

The Bank has four shareholders, each with a holding of between 20 percent and 27.5 percent. The shareholders operate under a policy of non-interference in management decisions and the Bank’s operations. The positive reputation and widespread business and government relations of the Bank’s shareholders in Afghanistan have contributed significantly to the success of the institution. Each shareholder appoints one person to the Board of Supervisors.

Board of Supervisors

The major purpose of the Board of Supervisors is to ensure that the Bank’s overall strategic and financial objectives are met, and that the risks associated with a financial institution operating in Afghanistan are managed and monitored.

The Board of Supervisors comprises the Chairman, four shareholder representatives, and four independent directors. The Chairman is also an independent director, in compliance with Central Bank regulations. Independent Board members are in the majority, in line with international governance standards. Brief biographical profiles of the nine current directors are included in this annual review.

The Chairman is a non-executive director and is responsible for leadership of the Board and ensuring its effectiveness. The four shareholder representatives are appointed by the respective shareholders of the Bank and represent the interests of these shareholders. Finally, the independent directors are expected to bring impartial judgment to the Board through their expertise in the financial world as well as governance experience. Independent directors and directors who are shareholder representatives are appointed every four years.

The Board has established four committees: the Compensation Committee, the Risk Committee, the Investment Committee, and the Planning and Strategy Committee. A fifth committee, the Audit Committee, reports directly to the shareholders as specified in the Law of Banking in Afghanistan and Central Bank regulations. Each committee has a formal charter to guide its activities.

The Board of Supervisors meets monthly: four times in person and the balance by conference call. The Board committees meet four times a year in person and in conjunction with Board meetings, with occasional conference calls. The Audit Committee meets four times annually. Board committee meetings are attended by the Chief Executive Officer and the Chairman of the Audit Committee. Minutes of committee meetings are circulated to all Board members for their information. The role of these committees is explained in more detail in the ‘AIB Committees’ section.

Management Board

The Board has delegated day-to-day operational responsibilities to the Chief Executive Officer and the Management Board. The Management Board is a formal entity with its role and responsibilities defined in the Law of Banking in Afghanistan and Central Bank regulations. The Board comprises: the Chief Executive Officer, Head of Commercial Banking, Chief Operating Officer, and Chief Financial Officer. The Management Board meets frequently concerning matters of policy, procedures, and operations. Brief biographical profiles of Management Board members are given on page 14 of this report.

In addition to the Management Board, the management structure of the Bank includes the Head Office Credit Committee, the Head Office Risk Committee, and the Head Office Asset Liability Management Committee. All three operate under defined charters and sets of policies and procedures approved by the Board of Supervisors and the shareholders.