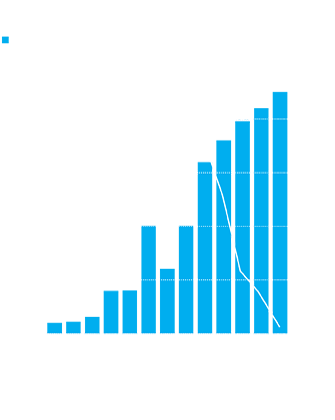

Afghanistan has sustained robust economic growth for the past decade, averaging 10 percent annually since 2002 and becoming one of the best performers in South Asia.

This positive economic growth trend was maintained in 2012 when the economy grew 11.8 percent – a significant increase from a year earlier when real GDP growth was 7.3 percent. GDP per capita stood at $576 at the end of 2012. The sharp rise in 2012 economic growth was mostly due to the agricultural sector, where good rains led to bumper harvests across the country. The good harvest also slowed inflation to 4.6 percent in July 2012 on a year-on-year basis, although it had edged up to 6.4 percent by year end.

Agriculture (which accounts for about 35 percent of GDP) was the fastest-growing sector, recording growth of about 14.2 percent, followed by the services sector at 12 percent.

Household consumption accounted for 5 percent of the year’s GDP growth and was largely driven by the security economy and donor spending, which continued to generate strong demand for jobs, goods and services, and housing construction.

Longer-term projections are less positive of sustaining the growth trend of the past decade. The three transitions taking place in 2014 economic, political, and security could lead to a drop in economic performance with real GDP growth slowing from the average of 10 percent per year over the past decade to 3.1 percent in 2013, 4.7 percent in 2014, and 4.9 percent in 2015.

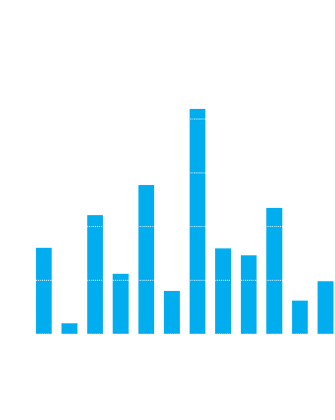

Donor support in 2012 continued to be strong, facilitating a further buildup of gross international reserves to about $6.8 billion (equivalent to six months of imports) and up by close to 10 percent from $6.2 billion in 2011. The foreign aid numbers are staggering. An estimated 97 percent of Afghanistan’s roughly $15.7 billion gross domestic product comes from international military and development aid and spending in the country by foreign troops.

Since 2002 donor pledges for Afghanistan amount to $119 billion, including $16 billion pledged at the Tokyo Ministerial conference in July 2012 and $14 billion pledged at the Chicago NATO summit in May 2012. While these recently announced pledges are promising, reported data projects a decline in the volume of foreign aid between 2012 and 2014, with the $6.4 billion provided in 2012 decreasing to $4.5 billion in 2013 and $797 million in 2014.

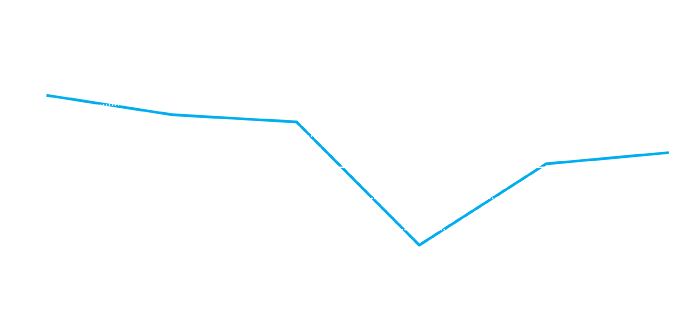

The Afghani has depreciated against the US dollar – mostly due to lower foreign capital inflows as aid and military spending were scaled back in anticipation of the 2014 troop withdrawals. The nominal exchange was highly volatile in 2012, starting the year at AF49 per USD and hitting a mid-year low of AF55 before ending slightly up at AF52.5.

Developments in international financial markets have also had an impact, and the crises of recent years – in the Eurozone, the US fiscal cliff, and fears of a UK triple-dip recession – have not only depressed global financial market activity but have had knock-on effects on the profitability of Afghan banks (AIB apart).

Actions by developed country central banks, such as ‘quantitative easing’ by the US Federal Reserve and large-scale liquidity injections by the European Central Bank, have stabilised developed economies but lowered yields on interest rates.

Against this background, the key macroeconomic challenge facing the Afghan Government is how to manage declining aid, mitigate the adverse impacts, and put aid and spending on a more sustainable long-term path.

With respect to the banking sector, the main challenge appears to be where to achieve inflation-beating returns in a low interest rate world, without taking on too much risk.

AIB’s Board, through its Risk Management and Strategy and Planning committees, is putting in place mechanisms to rigorously monitor the rapidly changing economic conditions so as to better manage the downside risks and identify opportunities.

Net lending to the private sector is slowly recovering from the Kabul Bank crisis and the yield on capital notes is at its lowest levels in years.

In the face of these developments, AIB’s Board will continue to seek inflation-beating returns in a low interest rate world, without taking on too much risk, so as to maximise shareholder value.

Overall, we are guardedly optimistic that Afghanistan will find a way to meet the challenges of the post-2014 environment. This view is evidenced by the investments we plan to make in our institution.

Notes:

– Banking industry numbers are annualised to take account of the shift from March-March to December-December reporting.

– Specific banking sector data is for end-November, 2012.