Annual Report 2018

Your Partner for Growth

Governance Report and AIB Committees

As a matter of principle and good business practice, AIB has conducted its banking business in an ethical, prudent, and professional manner, according to international standards of governance.

Philosophy of governance

AIB endeavours to enhance shareholder value; protect the interests of all stakeholders including shareholders, customers, employees, regulators and the public at large; and to ensure compliance with international best practices for financial institutions. The Bank complies with all legal and regulatory requirements of Afghanistan – but also formulates and adheres to strong corporate governance practices beyond what is mandated by Afghanistan regulators. In fact, ‘international’ in our name reflects the standard of performance we strive to achieve.

The adoption and implementation of corporate governance is the direct responsibility of the Board of Supervisors. In this role, the Board ensures that the management of the Bank is meeting the requirements and obligations of good governance.

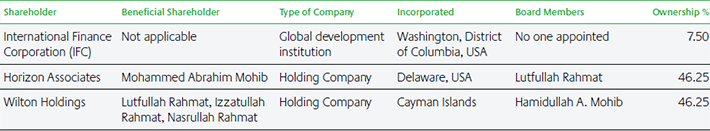

Shareholders

The Bank has three shareholders, each with an ownership percentage as shown in the table below. The shareholders operate under a policy of non-interference in management decisions and the Bank’s operations. The positive reputation and widespread business interests and relationships of the Bank’s shareholders in Afghanistan have contributed significantly to the success of the institution. Each shareholder has the right to appoint one individual to the Board of Supervisors.

Board of Supervisors

The major purpose of the Board of Supervisors is to formulate the overall strategic and financial objectives of the Bank; to monitor these objectives to ensure they are met by management; and to ensure that the risks associated with operating a financial institution in Afghanistan are managed and mitigated as far as possible. Ensuring the upholding of good corporate governance is key to the Bank achieving its goals, and the Board ensures that best practices are maintained.

The Board is composed of the Chairman, shareholder-appointed directors and independent directors. The Chairman is an independent director, which complies with central bank regulations. Independent Board members are in the majority, in line with regulations and international governance standards. According to the Articles of Association, each shareholder has the right to appoint one shareholder-designated director. The shareholders have agreed to a Board of Supervisors consisting of seven individuals. There are currently seven Board members: five independent and two shareholder-appointed. Brief biographical profiles of the directors are included in this annual report.

The Chairman is a non-executive director and is responsible for leadership of the Board and ensuring its effectiveness. Shareholder-nominated directors are appointed by the respective shareholders and represent their interests. There are currently two shareholder-appointed directors.

Independent directors are expected to bring impartial judgement to the Board through their expertise in the financial world, as well as governance experience through having served on other boards. Independent directors and directors who are shareholder representatives are elected/appointed for terms of four years, but must stand for reappointment each year.

The Board has five committees: Remuneration; Nominating; Risk; Planning and Strategy, and Audit. Each committee has a Chairman and a formal charter to guide its activities. The Board Chairman, with advice and consent of the full Board, selects committee members and committee chairs annually.

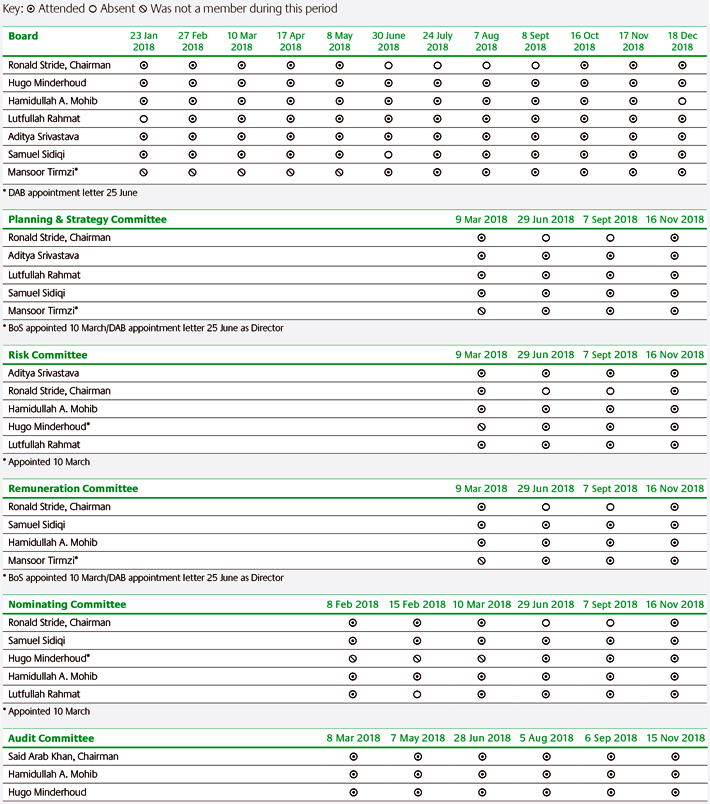

The Board of Supervisors meets monthly: four times in person and the balance by conference call. The committees of the Board meet four times a year in person and in conjunction with Board meetings, with occasional conference calls. Board committee meetings are attended by the Chief Executive Officer. Minutes of committee meetings are circulated to all Board members for their information. The role of these committees is explained in more detail in the following subsections.

In 2018, the Board met 12 times. During each meeting, the Board monitored the financial performance of the Bank as well as the status of non-performing loans and operational risks. Each quarter, the Board reviewed the anti-money laundering/ compliance dashboard to ensure the Bank’s adherence to the policies and procedures established for this function by outside experts. The Bank has invested significant resources into compliance, resulting in very satisfactory implementation of these policies and procedures, although more needs to be done.

The Board was intimately involved and actively drove compliance changes and oversaw the expansion of our correspondent relationship network, resulting in a new US$ Nostro account with UK, Kazakhstan and Uzbekistan banks. We look forward to the continued expansion of our network of correspondent banks in 2019 to include Russia and other countries.

The Board and shareholders had planned to have the Bank’s new headquarters building completed in 2016, but unfortunately due to delays primarily caused by security issues, occupation only took place in the last quarter of 2018. We are proud to finally have our own headquarters and the Board looks forward to holding Board meetings there.

Planning and Strategy Committee

The Planning and Strategy Committee is responsible for AIB’s strategic plan, annual business plan and budget, and for monitoring the Bank’s investment portfolio.

In 2018, the committee met four times in person. Specific accomplishments during the year were:

Reviewed and approved the business and financial plan for 2019; the plan shows an increase of 14 percent in pre-tax net profit and return on equity of 17 percent before dividend payment.

Monitored management initiatives to improve customer service in branches. These initiatives involve technology and process improvements and have resulted in better service delivery to customers.

Refined planning by business unit/segment:

Developed plans for each business unit: corporate and institutional, business banking, community banking, and consumer banking.

Developed profit and loss statements and balance sheets for each business unit

Established a method of monitoring of each unit’s plan.

Monitored the investment portfolio and approved allocation of funds across a number of investment instruments and asset managers. The investment portfolio yielded over 3 percent in interest income – more than $6.3 million – and accounted for 20 percent of total revenue.

Approved a shift to placements as opposed to bonds due to higher interest rate environment.

Approved model branch cost/benefit analysis to include branch staffing and organisation, physical layout, cost structure. service standards and performance measures.

Approved a branch rationalisation programme to reduce costs in the branch network in light of a stagnant business environment.

Approved a revised organisation structure for the Bank.

As a part of its on-going responsibilities, the committee monitored progress of the 2018 business plan and budget each quarter. As the political, security and economic conditions in Afghanistan are not likely to improve in 2019, the committee has taken a conservative approach to planning the Bank’s activities and finances.

Risk Committee

The committee provides comprehensive oversight and best practices in risk governance and risk management.

The principal role of the committee is to review the Bank’s risk exposure under different products. This encompasses foreign exchange positions, assets and liabilities, capital adequacy, credit and market risk, and sovereign risk. The committee also reviews performance of the classified and non-performing loan portfolio, and, most importantly, reviews and submits to the Board of Supervisors all the Bank’s policies associated with risk management. Finally, the committee identifies unacceptable risk conditions to the full Board for consideration and action.

The Board and the shareholders of AIB continued to place high priority on implementing, maintaining and developing the highest standards in anti-money laundering (AML) and counter-terrorism financing (CTF). During the year, AIB implemented a financial crime compliance/AML project with the assistance of a reputed external firm to ensure ‘know your customer’, AML and CTF processes are best in class. AIB also engaged the services of another prominent consulting firm, which works closely with several financial institutions, to ensure that AIB’s AML and CTF processes were working satisfactorily. The findings were positive.

The Bank retained the services of an external consultant who completed a credit risk review of the Bank’s loan portfolio, with recommendations being implemented as well as refinements to the Bank’s business continuity plan.

The Bank is also in the process of implementing an enterprise risk management system that will further strengthen its risk culture.

Due to uncertainties in the economic outlook for Afghanistan, the Risk Committee adopted a conservative approach for the Bank’s risk profile. This approach will continue in 2019 to ensure that the balance between risk and return is maintained.

Audit Committee

The Audit Committee is responsible for overseeing financial reporting; compliance with risk management policies and procedures; internal controls; ethical behaviour; and management and functioning of the Internal Audit Department.

The committee currently has three members, all qualified and experienced in audit, accounting, business or banking. The Board of Supervisors appoints members to the committee, the majority of whom consist of independent members of the Board of Supervisors, or any other qualified person, subject to the approval of Da Afghanistan Bank (the central bank), and that at least one of the committee members has sufficient experience in banking, accounting, or financial management. Any individual who is proposed to join the Audit Committee is subject to the same ‘fit and proper’ requirements as any other member of the Board of Supervisors. The committee currently has one non-Board member and two members of the Board of Supervisors.

The Audit Committee is responsible for the relationship with the external auditor, and meets them on completion of the annual audit and quarterly reviews. On the committee’s recommendation, the Board of Supervisors approves the annual financial statements and three quarterly reviews of condensed financial information. These meetings enable committee members to discuss matters relating to the external auditor’s remit and issues arising from the audit.

Consistent with previous years, in 2018 the Audit Commitee assessed and approved the annual internal audit plan, including budget and resources, and regularly monitored progress of the plan. The committee discusses control environment issues reported by the Internal Audit Department, their root causes and management responses, and remediation activities including any significant audit issues that were brought to the committees attention. The committee regularly monitors and assesses the role and effectiveness of the internal audit function.

The Audit Commitee also reviews the Bank’s annual budget and business plan, and recommends to the Board of Supervisors the payment of dividends.

The committee receives quarterly reports from major operational segments such as non-performing loans, operational loss, and financial reports of the Bank, reviewed at every quarterly committee meeting. The reports include the key performance indicators of these segments and issues related to operational and financial controls.

During 2018, the committee regularly focused on the status of internal controls and issues relating to money laundering and countering financial terrorism.

Da Afghanistan Bank issued a regulation that from the first quarter of 2019 Board members cannot serve as members of the Audit Committee. Accordingly, we are searching for Afghans who are qualified to sit on the committee.

Remuneration Committee

The Remuneration Committee has five major responsibilities:

Establish compensation policies for the Bank’s senior management, including base salary, fringe benefits and bonus scheme.

Establish performance goals for each member of senior management and monitor performance against these goals.

Establish and review development and succession plans for senior management.

Recommend to the full Board for final decision matters relating to senior management compensation and bonus actions.

Review and approve the Bank’s human resource policies.

The Committee has four members, three of whom are independent directors including the Chairperson. The Committee met four times in person in during 2018. Key issues addressed included:

Reviewed, approved, and monitored senior management goal statements.

Reviewed and approved 2017 bonus and salary actions for senior management.

Reviewed and approved an amended human resources policy.

Reviewed and revised executive and senior management bonus scheme.

Reviewed succession planning progress report and rotation plans.

It is critical for AIB to be clear in its commitment towards staff and in the credibility of its plans to keep talented employees and attract new ones from a pool of talented people who might otherwise consider employment abroad. The Committee thinks AIB has largely been successful in this by maintaining a professional and committed team.

Nominating Committee

The Nominating Committee works as a preparatory committee for the Board of Supervisors with respect to nomination and appointment of candidates to the Board of Supervisors, the Management Board, and other key senior managers as determined by the committee.

The committee comprises five members of the Board of Supervisors, including the Chairman; two members representing employees; and two members representing shareholders. A majority of the members are independent. At least one-third of the independent directors are committee members.

In 2018, the Committee met four times in person, in conjunction with Board meetings, and held conference calls to interview Board candidates. The Committee’s major activities for 2018 were:

Interviewing candidates to fill one open Board position: two candidates were interviewed by the Board, and one was nominated for approval to the full Board, and subsequently to the shareholders and the central bank.

Review and revision of its charter.

Approving the appointment of a Shariah Board member.

Running a selection process for a preferred search firm.

Submitting existing Board members for re-appointment at the Annual General Meeting of shareholders.

The Committee focused on strategically thinking about how to support the sustainability of the Bank through proper selection and succession planning.

Committee meetings and attendance records