Good corporate governance is a key factor in the success of AIB, and has been a major contributor to establishing the Bank’s reputation for integrity, high service standards, and financial performance.

Philosophy of governance

AIB endeavours to enhance shareholder value, to ensure compliance with international best practices for financial institutions, and to protect the interests of all stakeholders – whether shareholders, customers, employees, regulators, or the public at large. The Bank complies with all the legal and regulatory requirements of Afghanistan, but also formulates and adheres to strong corporate governance practices that exceed regulatory stipulations.

The adoption and implementation of corporate governance is the direct responsibility of the Board of Supervisors. In this role, the Board ensures that the management of the Bank meets the requirements and obligations of good governance.

Shareholders

The Bank has two shareholders, each with 50 percent ownership. The shareholders operate under a policy of non-interference in management decisions and the Bank’s operations. The positive reputation and widespread business interests and relationships of the Bank’s shareholders in Afghanistan have contributed significantly to the success of the institution. Each shareholder appoints one person to the Board of Supervisors.

Board of Supervisors

The primary purpose of the Board of Supervisors is to formulate the overall strategic and financial objectives of the Bank, to monitor these objectives and ensure they are met, and to the greatest extent possible, oversee the management and mitigation of the risks associated with operating a financial institution in Afghanistan. Upholding good corporate governance is key to achieving the Bank’s goals, and the Board ensures that best practices are maintained.

The Board comprises the Chairman, two shareholder representatives, and three independent directors. The Chairman is also an independent director, in compliance with Central Bank regulations.

Independent Board members are in the majority, again in line with regulations and international governance standards.

The single Board vacancy results from the resignation of Mr Hasib Ahmed, following the Asian Development Bank’s selling of its final stake in AIB during 2016. This position will be filled at the annual general meeting of shareholders in early 2017. Brief biographical profiles of the six current directors are included in this annual review.

The Chairman is a non-executive director and is responsible for leadership of the Board and ensuring its effectiveness. The two shareholder representatives are appointed by the respective shareholders of the Bank and represent the interests of these shareholders.

The independent directors are expected to bring impartial judgement to the Board through their expertise in the financial world and their experience of good governance. Independent directors and directors who are shareholder representatives are appointed every four years.

The Board has six committees: the Remuneration Committee, the Risk Committee, the Investment Committee, the Nominating Committee, the Planning and Strategy Committee, and the Audit Committee. Each committee has a formal charter to guide its activities. The Board of Supervisors meets monthly: four times in person and the balance by conference call.

Committees meet four times a year in person and in conjunction with Board meetings, with occasional conference calls. Board committee meetings are attended by the Chief Executive Officer. Minutes of committee meetings are circulated to all Board members for their information. The role of these committees is explained in more detail in later sub-sections of this report.

In 2016 the Board met 13 times. During each meeting, the Board monitored the financial performance of the Bank as well as the status of non-performing loans and operational risks.

Each quarter, the Board reviewed the anti-money laundering/compliance dashboard to ensure the Bank’s adherence to the policies and procedures established for this function by outside experts. The Bank has invested significant resources in compliance. This investment has resulted in very satisfactory implementation of these policies and procedures, although more needs to be done.

The Board also addressed the six major objectives for the year that were highlighted by the Chairman in his message:

• Achieve world-class standards in anti-money laundering and compliance

• Complete the new head office building by the end of 2016

• Focus on organisation and human resource development

• Position for the future in under-served markets and product offerings

• Maintain existing correspondent banking relationships and develop new relationships for US dollar clearing

• Maintain financial stability and satisfactory returns

Planning and Strategy Committee

The Planning and Strategy Committee is the committee of the Board of Supervisors responsible for AIB’s strategic plans and annual business plans and budgets. Specifically, the committee provides:

1. Oversight of the strategic direction of the Bank and preparation of its three-year strategic plan

2. Development, adoption, and modification of the Bank’s annual business and financial plan

3. Response to external developments and factors, such as changes in the economy, competition, security, and political situation, that impact the Bank’s strategy

4. Examination and recommendation of acquisitions, joint ventures, and strategic alliances

5. Liaison with external experts and consultants as required

6. Development of early warning ‘event and response’ framework

7. Examination of such matters as the Board may from time to time determine.

During 2016 the committee met four times, with a primary focus on approving and monitoring the annual business plan and budget of the Bank. The committee also reviewed the impact of fee increases on the Bank’s business; plans to reduce security and leasing costs; actions to increase cross-selling opportunities; and improvements in branch profitability. These initiatives increased revenue and reduced costs for the Bank.

The committee also reviewed the impact of the new Law of Banking in Afghanistan on the operations, policies, and procedures of the Bank to ensure compliance with the Law. Finally, the committee approved a contingent organisation structure in the event of a security emergency.

As the political, security, and business sentiment situation in Afghanistan is unlikely to improve substantially in the near term, the committee recommended a conservative approach to business plans and updating the Bank’s strategic plan to reflect these conditions.

The committee’s members are: Ronald Stride (Chairman and independent director), Aditya Srivastava (independent director), Veronica John (independent director), and Lutfullah Rahmat (shareholder-appointed director).

Risk Committee

The Board’s committee to provide comprehensive oversight and best practices in risk governance and risk management comprises Aditya Srivastava (Chairman and independent member), Hamidullah A. Mohib, Lutfullah Rahmat, and one independent Board member – Ronald Stride.

The principal role of the committee is to review the Bank’s risk exposure under different products. This encompasses foreign exchange positions, asset and liabilities, capital adequacy, credit and market risk, and sovereign risk. The committee also reviews performance of the classified and non-performing loan portfolio, and, most importantly, reviews and submits to the Board of Supervisors all the Bank’s policies associated with risk management. Finally, the committee identifies unacceptable risk conditions to the full Board for consideration and action.

The Board and the shareholders of AIB place high priority on implementing, maintaining, and developing the highest standards in anti-money laundering (AML) and counter-terrorism financing (CTF). During the year, AIB completed a financial crime compliance/ AML project with the assistance of a reputed external firm to ensure ‘know your customer’, AML, and CTF processes are best in class. The committee introduced a measure to ensure the early detection of borrowers who appear to be having problems in their business. The committee also oversaw other key initiatives during the year, including an external consultant completing a credit risk review of the Bank’s loan portfolio, with recommendations currently being implemented, as well as refinements to the Bank’s business continuity plan. A new chief risk officer has been appointed to further strengthen the risk function.

The committee was pleased to note that the external consultancy that conducted an IT penetration audit had commended AIB’s IT architecture and provided assurance that the Bank would be able to withstand an external attack on its systems.

Due to uncertainties in the economic outlook for Afghanistan, the Risk Committee adopted a conservative approach for the Bank’s risk profile. This approach will continue in 2017 to ensure that the balance between risk and return is maintained.

Investment Committee

The Investment Committee comprises three directors, all of whom are independent, including the Chairman, Salman Shoaib. The other members are Ronald Stride and Aditya Srivastava.

The committee’s mandate covers allocation, investment, and oversight of a portfolio of fixed-income securities, and also management of liquidity including placements with other banks. Its principal role is to oversee the Bank’s investment policy and to ensure this is modified and executed in the context of the Bank’s risk and capital parameters. In this regard, the committee works with the Board and management to develop investment policies, oversee investment of the Bank’s funds, and monitor the mandate and performance of independent asset managers hired by the Bank. The committee recently took an active role in reviewing placements.

The committee conducted ongoing reviews of the performance of the two asset managers against pre-set return on investment targets. The committee commented on the performance of the managers, and made recommendations to management on potential steps to enhance performance or achieve objectives, including adjusting risk parameters to improve yield and ensure that the Bank’s fixed-income portfolio remained in compliance with regulations from the Central Bank.

Audit Committee

The Audit Committee was established under the Law of Banking in Afghanistan then in place. In 2016, the amended Law of Banking in Afghanistan was enacted, requiring the Audit Committee to become a committee of the Board of Supervisors. The Board of Supervisors is, however, allowed to appoint members to the Audit Committee who are not members of the Board of Supervisors. Any non-member of the Board of Supervisors is subject to the same fit and proper requirements as members of the Board of Supervisors. The committee has three members, all qualified and experienced in audit, accounting, or banking.

Dr Patrick Asea assumed the position of acting chairman following the resignation of Mr Anthony Barned on becoming CEO. Dr Asea resigned on leaving Afghanistan, and in August Mr Said Arab Khan, retired senior partner of KPMG, was appointed chairman.

The Audit Committee is responsible for overseeing financial reporting, compliance with risk management policies and procedures, internal controls, ethics, and management and functioning of internal audit. In 2016, the committee assessed and approved the annual internal audit plan, including budget and resources, and regularly monitored progress of the plan during the year. The committee also reviewed the Bank’s annual budget and business plan and recommended the payment of an interim dividend to the Board of Supervisors.

The committee regularly monitors and assesses the role and effectiveness of the internal audit function.

The committee receives quarterly reports from major operational segments of the Bank, which are reviewed at every quarterly Audit Committee meeting. The reports include the key performance indicators of different segments and issues related to operational and financial controls.

At its quarterly meetings, the committee discussed control environment issues reported by the Internal Audit Department, their root causes and management responses, and remediation activities. Any significant audit issues were also brought to the committee’s attention.

The committee is also responsible for relationships with the external auditors, and meets them on completion of the annual audit and quarterly reviews. On the recommendation of the Audit Committee, the Board of Supervisors approves the financial statements of the Bank. These meetings allow committee members to discuss matters relating to the external auditors’ remit and issues arising from the audit.

During 2016, the committee regularly focused on the controls and issues related to anti-money laundering and counter-terrorism financing.

Remuneration Committee (formerly the Compensation Committee)

The committee comprises four directors, three of whom are independent, including the Chair, Veronica John. The other members are Ronald Stride, Salman Shoaib, and Hamidullah A Mohib.

The committee’s remit was reviewed during the year, to ensure compliance with the amended Law of Banking in Afghanistan, as well as the revised Corporate Governance Regulations. This resulted in the creation of a separate Nominating Committee to oversee matters relating to the appointment of Board members and recruitment of executive management, while the Remuneration Committee adopted a slightly revised charter, with its role focused on two key areas:

• Establish the compensation philosophy and structure for the executive management, and oversee and evaluate their performance relative to the approved goals set in line with this structure

• Review and make recommendations regarding the compensation policy for members of the Board of Supervisors

In this role, the committee establishes guidelines for base salary, bonus, and fringe benefits for each executive, and recommends to the Board any changes to the compensation structure.

During 2016, the committee met four times in person and held one conference call.

The committee reviewed and recommended for Board approval the compensation packages for new executive appointments, in line with current policy. The committee also reviewed, and reported to the Board, the performance of senior management through a formal goal-setting and monitoring mechanism.

It also reviewed progress with the reorganisation of the HR function and recommended for Board approval a cost of living increase applicable to all staff effective from 2017. The committee will continue in 2017 to monitor the implementation of an updated HR policy, which will better conform to international practices, and oversee the review of the executive management compensation policy and guidelines.

Nominating Committee

The Nominating Committee was formed during the year in compliance with new regulations in Afghanistan, and comprises five directors, the majority of whom are independent, including the Chair, Veronica John. The other members are Ronald Stride, Salman Shoaib, Hamidullah A Mohib, and Lutfullah Rahmat. Two members of the committee are designated as representing employees and two as representing shareholders.

In 2016, the committee focused on the composition of the senior management team, overseeing the development and recruitment actions required to bring the team to a full complement with the optimal balance of skills and experience. In particular, the committee was involved in the selection process for a number of key appointments, not least the Bank’s new CEO and DCEO. Focus continued on the development of several ‘high flyer’ Afghan staff identified as demonstrating the potential to grow into executive management within AIB, in line with the future vision for the Bank.

The committee received updates during the year on progress of initiatives to ensure the Bank’s female staff have access to enhanced working opportunities and that there is satisfactory support for working mothers.

The committee also made recommendations on the composition of the Board’s committees and considered succession planning for the Board of Supervisors, also overseeing the development of a checklist to better guide the future evaluation of candidates proposed for appointment.

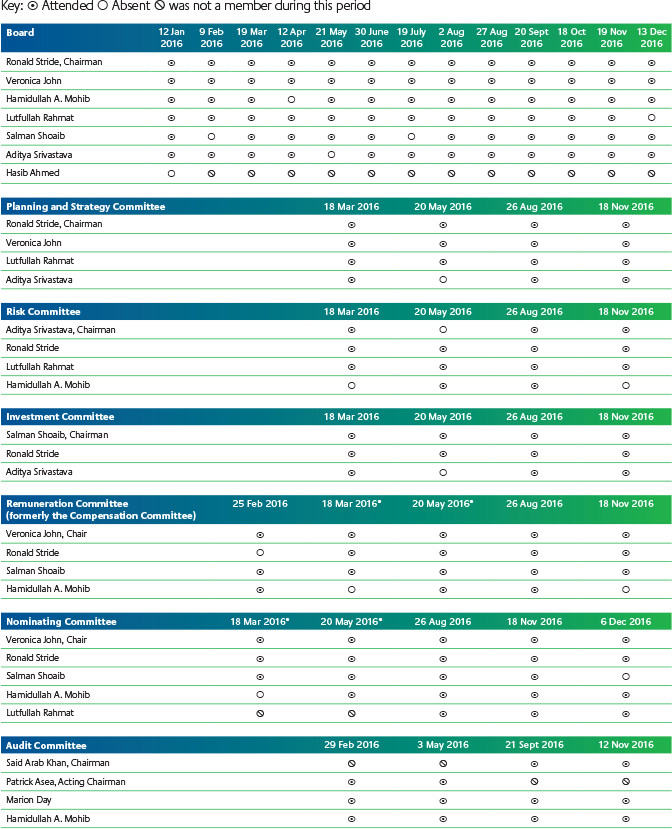

Committee meetings and attendance records

* Denotes joint meeting of the Remuneration and Nominating Committee.

Full Report

Full Report