Governance Report

and AIB Committees

The shareholders and Board of Supervisors are committed to a high level of corporate governance, and to ensuring that the Bank’s management practices are always aligned with the principles of good governance.

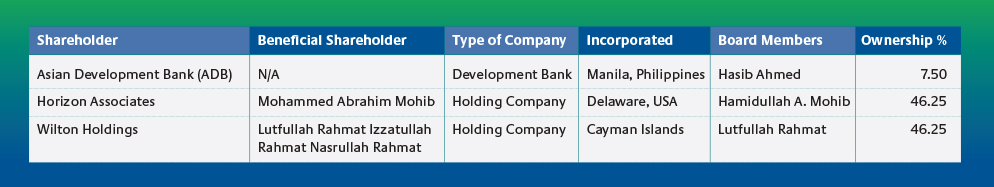

Shareholders

The Bank has three shareholders, two holding 46.25 percent each and one with 7.5 percent. The shareholders operate under a policy of non-interference in management decisions and the Bank’s operations. The positive reputation and widespread business and Government relations of the Bank’s shareholders in Afghanistan have contributed significantly to the success of the institution. Each shareholder appoints one person to the Board of Supervisors.

Board of Supervisors

The main purpose of the Board of Supervisors is to ensure that the Bank’s overall strategic and financial objectives are met, and that the risks associated with a financial institution operating in Afghanistan are managed and monitored.

The Board of Supervisors comprises the Chairman, three shareholder representatives, and four independent directors. The Chairman is also an independent director, in compliance with Central Bank regulations. Independent Board members are in the majority, in line with international governance standards. Brief biographical profiles of the eight current directors are included in this annual review.

The Chairman is a non-executive director and is responsible for leadership of the Board and ensuring its effectiveness. The three shareholder representatives are appointed by the respective shareholders of the Bank and represent the interests of these shareholders.

Finally, the independent directors are expected to bring impartial judgement to the Board through their expertise in the financial world as well as governance experience. Independent directors and directors who are shareholder representatives are appointed every four years.

The Board has established four committees: Compensation, Risk, Investment, and Planning and Strategy. A fifth committee, Audit, reports directly to the shareholders as specified in the Law of Banking in Afghanistan and Central Bank regulations. Each committee has a formal charter to guide its activities.

The Board of Supervisors meets monthly: four times in person and the balance by conference call. The Board committees meet four times a year in person and in conjunction with Board meetings, with occasional conference calls. The Audit Committee meets four times annually. Board committee meetings are attended by the Chief Executive Officer and the Chairman of the Audit Committee. Minutes of committee meetings are circulated to all Board members for their information. The role of these committees is explained in more detail in the ‘Governance Report and AIB Committees’ section.

Strategy and Planning Committee

The Strategy and Planning Committee’s mission is to provide oversight to AIB’s strategic planning and annual budgeting and planning processes, as well as the development of major new initiatives. Its members are: Brian Dickie (Chairman), Ronald Stride (both independent directors), Lutfullah Rahmat, and Hasib Ahmed.

In 2014, the committee oversaw projects related to head office reorganisation, new products for small business and retail customers, enhancement of management information systems, customer service improvements, and development of a contingency budget based on various scenarios.

The committee also made quarterly assessments of performance against the 2014 budget and business plan, and reviewed the proposed budget and business plan for 2015.

Risk Committee

The Board’s committee to provide comprehensive oversight and best practices in risk governance and risk management comprises Hasib Ahmed (Chairman), Hamidullah A. Mohib, and two independent Board members – Ronald Stride and Aditiya Srivastava.

The principal role of the committee is to review the Bank’s risk exposure under different products. This encompasses foreign exchange positions, assets and liabilities, capital adequacy, credit and market risk, and sovereign risk. The committee also reviews performance of the classified and non-performing loan portfolio and, most importantly, reviews and submits to the Board of Supervisors all the Bank’s policies associated with risk management. Finally, the committee identifies unacceptable risk conditions to the full Board for consideration and action.

During 2014, the committee mandated the introduction of a monitoring system to identify any increases in credit risk, and received regular reports on steps taken to improve the Bank’s ‘know your customer’ (KYC) and anti-money laundering (AML) compliance. The results of third-party reviews of the Bank’s IT security systems and the implementation of improvement recommendations were also monitored.

As the Bank’s present external auditors had served the maximum term allowed by the Central Bank, the committee considered a proposal from management to appoint a new firm and made a recommendation to the Board.

Due to uncertainties in the economic outlook for Afghanistan, the Risk Committee adopted a conservative approach for the risk profile of the Bank. This approach will continue in 2015 to ensure the balance between risk and return is maintained.

Compensation Committee

The Compensation Committee comprises three directors, two of whom are independent, including the Chairperson, Veronica John. The other members are Ronald Stride and Hamidullah A. Mohib.

The principal role of the committee is to establish compensation policy for the Chief Executive Officer, members of the Management Board, and other senior managers. These guidelines include base salary, bonus, and fringe benefits. The committee also reviews the performance of senior management through a formal goal-setting and monitoring mechanism. Yearly bonuses are established based on the Bank’s financial performance against the annual budget and individual management achievement of their goals. The committee also reviews human resource policies and procedures for employees.

The committee reports to the Board and shareholders on the targets, goals, and performance of management as well as proposed changes to the compensation structure and policies and procedures. The contracts for the Chief Executive Officer and independent directors are also determined by the committee and reported to the Board and shareholders.

In 2014, the committee completed the recruitment of a new Chief Executive Officer as part of a broader succession plan that will take place in early 2015. Other activities during the year included changing the methodology for calculating executive management bonuses, approving a medical insurance scheme for the staff (the first such scheme to be introduced by any Afghan company), approving the selection of a new Chief Risk Officer, and overseeing initiatives to equalise compensation of Afghan and expatriate senior managers and to elevate the focus on retaining and hiring more female professionals.

Investment Committee

The Investment Committee comprises three directors, two of whom are independent, including the Chairman, Salman Shoaib. Other members are Hasib Ahmed and Aditya Srivastava (independent), who was appointed to the committee on the resignation Gokhan Erkhal. The Chairman of the Bank attends meetings as an ex-officio member.

The committee’s mandate covers allocation, investment, and oversight of a portfolio of fixed-income securities. Its principal role is to oversee the Bank’s investment policy and to ensure this is modified and executed in the context of the Bank’s risk and capital parameters. In this regard, the committee works with the Board and management to develop investment policies, oversee investment of the Bank’s funds, and monitor the mandate and performance of independent asset managers hired by the Bank.

In 2014, the committee reviewed quarterly reports on the performance of the two Asset Managers against pre-set return on investment targets. The Committee also met the Asset Manager to understand developments in the fixed income markets.

The committee provided guidance to management on adjusting risk parameters to improve yield and ensure that the Bank’s fixed-income portfolio remained in compliance with regulations from the Central Bank. It sought approval from the full Board when required and highlighted issues that required attention.

Audit Committee

The Audit Committee is established under the Banking Act in Afghanistan. The committee reports directly to the shareholders and the committee’s Chairman, and its members are appointed at the annual general meeting of shareholders. Appointments are for not more than four years and may be renewed for like periods. Members of the committee are subject to the same fit and proper requirements as members of the Board of Supervisors. The committee has three members, all qualified and experienced in accounting or banking, and is responsible for overseeing financial reporting, compliance with risk management policies and procedures, internal controls, ethics, and management and functioning of internal audit. In 2014 the committee assessed and approved the annual internal audit plan, including budget and resources. Progress was also monitored regularly.

The committee is responsible for relationships with the external auditors and meets them on completion of the annual audit and quarterly reviews. On the recommendation of the Audit Committee, the Board of Supervisors approves the Bank’s financial statements. The Committee reviewed the appointment of new external auditors for 2015, recommending the terms of engagement and fees for Board approval.

In 2014 the committee scrutinised impairment charges on loans and advances, reviewing recovery efforts and monitoring possible impact of legal actions relating to operational losses, although the Bank has not been named in such actions. The committee continued to regularly assess the progress being made with regulatory compliance controls, including know your customer, anti-money laundering, and fraud.

Meetings are usually held four times a year (as in 2014) in person and in conjunction with Board meetings. The Chief Executive, Deputy Chief Executive, and other Management Board members attend the meeting on invitation. Minutes are presented at the next Board meeting, when the committee Chairman reports on matters requiring Board attention.